Pages

Monday, 21 May 2012

Death of a retired Police Officer - Chief Superintendent Leslie (Les) Granlund

Les retired from Durham Constabulary in 1985 after a long and distinguished career.

Death of a retired Police Officer - PC2042 Thomas Aikenhead

Mr Aikenhead retired from Peterlee in 1976. He had previously served at HQ, Wingate, West Hartlepool, C.I.D Admin and Chester le Street.

Thursday, 17 May 2012

Death of a retired Police Officer - Jeffrey Charles Leng

Tuesday, 15 May 2012

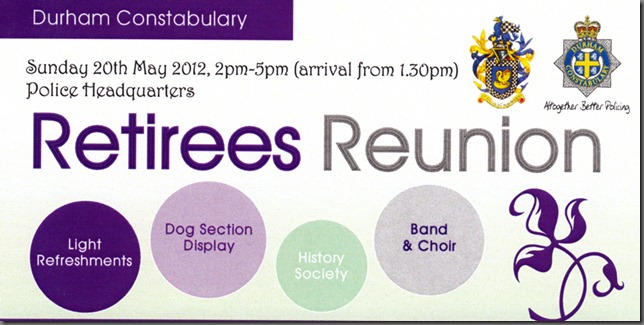

The 3rd Retirees Reunion and Social Afternoon

Those of you who are attending should have or will be receiving a ticket through the post which will be exchanged for a name badge at the reception desk upon arrival at HQ. Arrival is from 1330hrs.

Monday, 14 May 2012

Death of a Police Widow - Margaret Maughan

Tuesday, 8 May 2012

No Insurance for Texting Drivers

According to an AA survey of eight major insurers, half of them would not quote anyone who has been given three points for the CU80 offence, while the other half would raise their premium by 20%.

Spokesman Ian Crowder said: ‘Insurers are taking mobile phone offences very seriously. Their opinion is a motorist might break a 30mph speed limit without noticing but no one sends a text message, email or makes a phone call behind the wheel by accident.

‘It might seem severe but when operating a mobile phone you don’t have both hands on the steering wheel, you aren’t looking fully at the road and can’t change gears safely.’

More than 170,000 motorists a year in England and Wales are caught using their phones while driving.

Car insurers are refusing to cover motorists caught using a mobile phone at the wheel – even first-time offenders.

Auto Express magazine has found that some insurers will increase policy prices for offenders even more. A spokesman for Adrian Flux said: “Rises would vary from insurer to insurer, but could be anywhere from 15 per cent to 50 per cent or even a refusal.”

This tough stance extends to other offences, too. The table (below) spells out the AA’s findings, and as you can see, even a minor speeding violation – an SP30 – will send premiums soaring.

Seven of the eight cover providers contacted by the AA admitted that would be enough for a premium rise, and one wouldn’t even offer a quote.

Research suggests that premium hikes for speeders can be far higher than even the 9.3 per cent quoted by the AA.

A spokesman for LV said: “Typically, if a new customer had a speeding conviction in the last year, then their premium could rise by 10-20 per cent.”

The news will surprise many drivers, as traditionally insurers have opted not to penalise those with three points on their licence. A similar AA survey in 2009 found that 50 per cent of insurers would overlook a minor speeding offence.

When companies where asked why motorists’ premiums are now being hiked for this. An AA spokeswoman explained: “When speed cameras were first introduced, everyone was getting caught and insurers took a more lenient view, but now motorists are used to cameras, insurers won’t ignore three points.”

Direct Line said it was down to stats, with a spokesman adding: “Drivers with motoring convictions are 40 per cent more likely to claim than those with no convictions.”

An Association of British Insurers (ABI) spokesman said providers were hardening their view. “With the rising costs of claims, insurers hike premiums even in response to a motorist’s first three points,” he explained.

When asked why motorists caught using their phone at the wheel were penalised more harshly than speeders, even though three points are dished out for both offences. An AA spokesman said: “Anecdotal evidence suggests motorists caught using a mobile are twice as likely to make a claim than with other offences.”

Simon Douglas, director of AA Insurance, added: “Using a mobile phone while driving is a deliberate act. Many drivers may accidentally drift over a 30mph limit without realising. But no one accidentally makes or answers a call or text.”

How convicted drivers are being hit in pocket

The AA obtained quotes from eight unnamed insurers on its panel to see the effect of different offences on premiums. It based the figures on a 40-year-old man driving a Ford Mondeo.

Offence assumptions:

SP30 (speeding) – three points and £60 fine

CU80 (handheld phone) – three points and £60 fine

CD10 (careless driving) – six points and £100 fine

| Insurer | Clean | 1 x SP30 (3pts) | 2 x SP30 (6pts) | 1 x CU80 (3pts) | 1 x CD10 (6pts) |

| A | £298.15 | £332.73 | No quote | No quote | No quote |

| B | £312.79 | £344.07 | No quote | No quote | No quote |

| C | £331.33 | £366.2 | £398.92 | £376.72 | £423.44 |

| D | £378.2 | £395.98 | £509.06 | £499.22 | £504.52 |

| E | £391.5 | £441.22 | £491.33 | No quote | No quote |

| F | £491.28 | £508.63 | £532.55 | £563.99 | £588.55 |

| G | £434.17 | £466.73 | £494.95 | £495.39 | £505.81 |

| H | £434.44 | No quote | No quote | No quote | No quote |

| Avg increase | 9.3% | 23.6% | 18.5% | 24.4% |

Tuesday, 1 May 2012

Copper Plate – Spring 2012 (Issue 86)

Spring 2012 edition of Copper Plate can be viewed by clicking on the image.

You can view older editions of Copper Plate by clicking on the menu bar above or by CLICKING HERE

“Dust & Dreams” by Robin Trounson

Robin, who served with Durham Constabulary for 30 years, was on the point of retiring in 2008 when the chance arose to work in the Middle East.

He was invited to act as a specialist advisor with the Abu Dhabi force in the United Arab Emirates, working alongside several other Durham officers already based in the oil-rich Gulf state.

On his return to the UK last year, Robin decided to chart his experiences in a book called “Dust and Dreams – a window on the United Arab Emirates”, which he describes as part diary, part travelogue and part history.

The book touches on the difficulties of bringing a Western performance management ethos into a different culture, but concentrates on the wider picture of life in a rapidly changing Arab country.

Drawing on his law and ancient history degree, the author illustrates how the headlong rush to make the Emirates a hub for culture, sport and tourism sometimes sits uneasily with its traditions and relatively recent poverty.

“I had planned to travel in my retirement but this gave me the chance to work and travel at the same time,” said Robin. “The book is more about what I saw and experienced on my travels round the Emirates than the job I went there to do.

While we were there you had the start of the Arab uprising and yet, in that troubled part of the world you have a country now celebrating 40 years still united, which people said would never work, and yet it has.”

“Dust and Dreams” is available from The People’s Bookshop (0191 384 4399) in Saddlers Yard, Durham for £9.99. It can also be ordered through Amazon and at authorsonline.co.uk

All author’s royalties are going to “Plan”, a global children’s charity tackling poverty and suffering in some of the world’s poorest communities.